Deep Landscape Forecasting for Real-time Bidding Advertising, Ren et. al., 2019

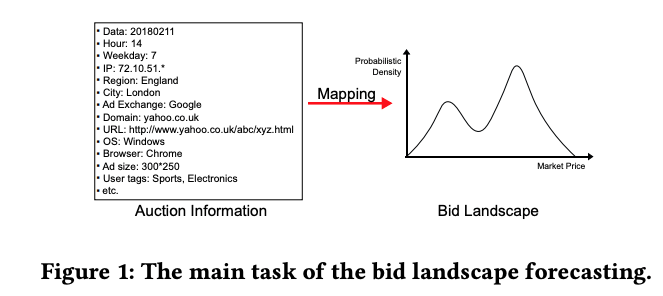

The topic of this week’s paper is predicting the price distribution in RTB auctions. More specifically, the goal is to predict the price landscape given various parameters of the auction request, such as date and user information.

Such a forecast is useful for profit maximisation in bidding systems. Three common practical challenges are that

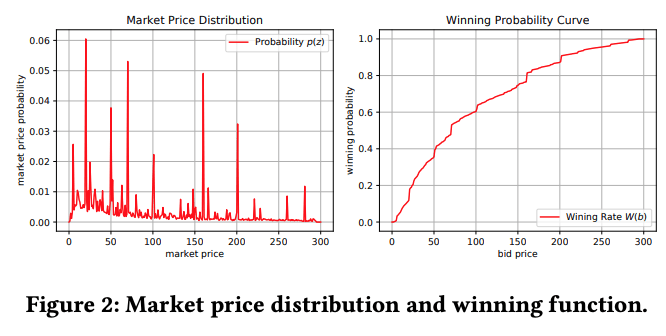

- real world bid and price distributions often have spikes at certain bid values due to many bidders submitting identical or very similar bids within and across auctions (see Figure 2),

- the data available to an individual bidder is generally censored. Specifically, the bidder observes the winning price only if she actually wins. If she doesn’t win, she knows her bid must have been equal or below the winning price but she does not know the winning bid or price. Also, she generally does not observe the bids of others. Moreover,

- it is generally impossible to model the bidding strategy of each competing bidder so empirical modelling is reduced to market outcomes, such as prices, rather than the mechanisms leading to the observed prices.

While most of the previous literature either uses nonparametric or parametric density estimation to estimate and predict the price landscape, the authors propose a recurrent neural network for this task.

To our knowledge, this is the first work that proposes an end-to-end deep learning model without any distributional assumptions for bid landscape forecasting.

Advantages of the deep learning implementation proposed in the paper are that

- the price distribution can be predicted for individual bid requests based on a large amount of data available for the request rather than a cluster or segment of requests

- there is no need for parametric restrictions on the distributional form of the price distribution and

- like models common in survival analysis, the approach can explicitly handle censored data.

The authors show that the their neural network approach outperforms other common prediction approaches on the two public real-world datasets iPinYou and YOYI that originate from logs of second price auctions.

Neural networks for distribution forecasting

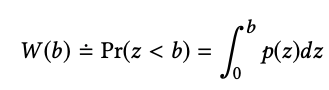

The main object of interest is the market price distribution conditional on request features, p(z|x), where z is the price and x are request features. This distribution can then be uses to assess winning probabilities conditional on a bid b and request-level information x. For example, the winning probability for a bid b is the probability that the bid is higher than the market price (conditioning on x omitted in the equation)

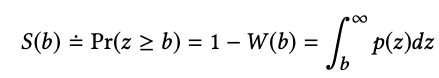

Similarly, the probability of not winning is

Data obtained from the bidding logs are {(x ,b, z)}, where z is unobserved whenever the bidder did not win the auction and b is only observed for the specific bidder.

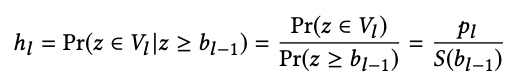

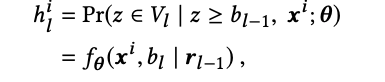

To apply what the authors term the Deep Landscape Forecasting (DLF) model, the bid and price distributions are discretised (0<b_1<..<b_l<..<b_L) and the following conditional winning probability for a bid b_l is being estimated using a recurrent neural network

The equation reflects the probably of the market price being in the interval V_l=(b_l, b_{l+1}) given the price is larger than bids smaller than b_l and can be interpreted as the conditional winning probability for bid b_l. The probability of winning and not winning can be derived from the above equation. Now, for every bid interval V_l, the neural network predicts h_l given inputs (x, b_l).

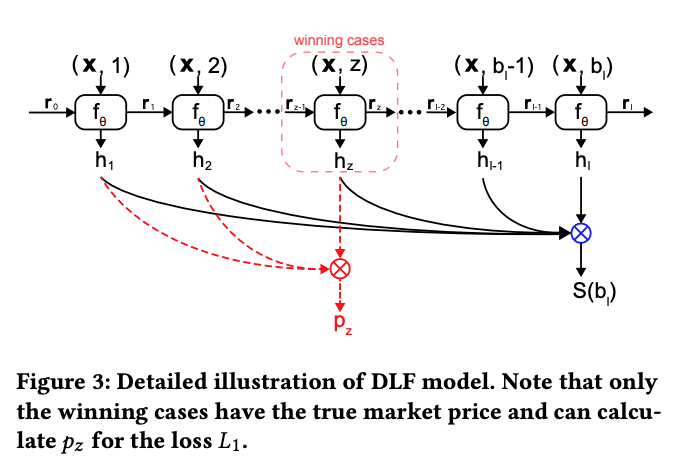

The loss function takes into account (i) the market price being z=z_i for the winning logs and (ii) the knowledge of z_i>b_i for the loosing logs, thereby accounting for censored observations of z. Figure 4 illustrates the censoring: The left graph shows a winning auction instance where the price is below the bid and hence known. The right graph shows a loosing instance where the price is not known to the bidder.

Model performance

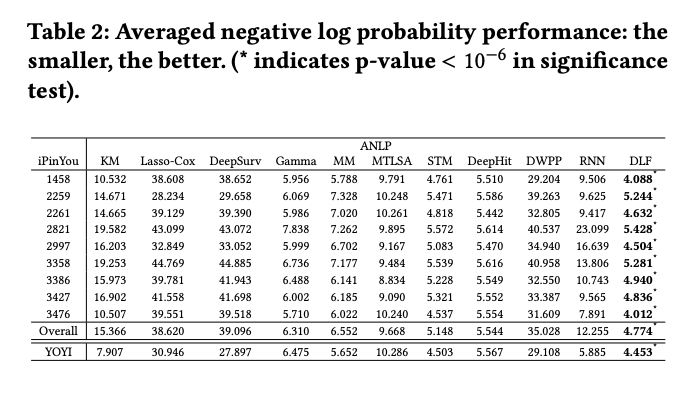

To evaluate the performance of the price distribution forecasts, the authors assess the likelihood of co-occurrence of market prices with predicted market prices under the learned price distribution for a test set, using the negative log probability averaged over all test instances (ANLP) as a metric. Table 2 shows the model outperforms various other approaches, such as a Kaplan-Meier estimator (KM), an estimator based on the Cox proportional hazard model and others on the iPinYou dataset.

Closing thoughts

The paper shows that neural networks are promising for estimating distributions when there is little or no prior functional form information for the distribution and/or common distributions don’t seem to be a fit for the data. The results are clearly sensitive to the underlying price distribution, which varies across datasets and over time. Hence, it would be interesting to understand in which cases neural networks perform better than, for example, parametric methods from survival analysis.

The paper also raises interesting questions around the motivation and need for predicting the price distribution. After all, a second price auction for a single item is truthful under the standard assumptions and just bidding a (predicted) valuation for an impression is (the only) dominant and profit-maximising strategy for a bidder. From this perspective, a bidder would not care about the price distribution. However, frictions such as budget constraints might induce bidders to adjust strategies to optimise for return on investment over multiple auctions, for example by entering auctions with a high predicted gap between own value and price and staying out of auctions where this gap is low.